The overall performance of the international steel market last week was complex and changeable, with significant price fluctuations for various products. In terms of semi-finished products, driven by monetary stimulus policies, export prices in the Chinese market have rebounded, especially steel billet prices, which have rebounded sharply. However, market performance in Southeast Asia and the Commonwealth of Independent States was divergent, with weak demand in some regions, resulting in price pressure. At the same time, the long steel market has been boosted by the favorable macroeconomic policies of various Asian countries, and prices have risen steadily. In particular, the Chinese and Turkish markets have performed well. In terms of the plate market, China's domestic trade and export markets have been significantly affected by policy stimulus, and prices have generally risen. Other regions around the world are facing the challenges of oversupply and weak demand.

In terms of semi-finished products, the international steel billet market showed price fluctuations last week. The Chinese market was driven by monetary stimulus policies and export prices rebounded. China’s November shipping billet transaction price rebounded to US$440/ton from US$430-435/ton FOB at the beginning of the week, and some steel mills even raised their quotations to US$450-455/ton FOB. However, Southeast Asian buyers are taking a wait-and-see attitude towards the high prices. The Turkish and Taiwanese markets have strong demand for Chinese steel billets and have obvious price support. In addition, the Southeast Asian market has risen due to the influence of the Chinese market, and billet import prices in Indonesia, Thailand and the Philippines have increased. Market performance in the CIS and the Middle East was relatively weak, especially export prices from Russia and Iran were under pressure. Overall, the market remains uncertain in the short term.

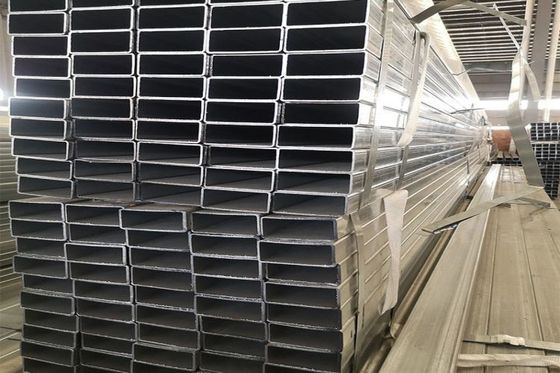

In terms of long products, last week, the overall performance of the Asian long products market was steady and rising. Affected by favorable macroeconomic policies, China's domestic trade market has seen an increase in building materials prices. Markets in Beijing-Tianjin-Hebei, Shanghai, Guangzhou, Zhejiang and other places are actively trading and market sentiment is picking up. The price increase in China's long steel export market is mainly due to the government's reduction of the deposit reserve ratio, which increased exporters' quotations. The Southeast Asian market rose slightly. The Indonesian and Vietnamese markets benefited from favorable macroeconomic policies, but the recovery in demand was limited. Price increases in India in the South Asian market were driven by raw material costs, but demand improved less than expected. Prices in the Turkish market have risen, supported by domestic demand, and the market is expected to be volatile and strong in the short term.

In terms of flat materials, the price of hot-rolled coils in China's domestic trade market fluctuated upward last week due to favorable macroeconomic policies, inventory fell, and market confidence was significantly boosted. In terms of exports, steel mills have increased their quotations for cold-rolled coils and hot-dip galvanized coils, and some buyers are still cautious. The price of hot rolled coils in the Southeast Asian market rose slightly due to China's favorable macroeconomic situation, but the increase in demand was limited and buyers had a strong wait-and-see attitude. Indian hot roll prices have increased, but due to oversupply and weak demand, market prices have fluctuated greatly. In the European and American markets, the price of hot coils in Europe continues to fall, and buyers are replenishing a small amount of goods as needed. The prices of hot coils in the U.S. market are stable, and there is uncertainty about the future trend.

Overall, the international steel market showed a complex fluctuation trend last week under the influence of multiple factors. The policy stimulus in the Chinese market has injected vitality into global steel prices, especially the prices of steel billets and long products have rebounded significantly. However, markets in Southeast Asia and the Commonwealth of Independent States are still constrained by weak demand, hampering price increases. Although the plate market has recovered somewhat, driven by China, other regions around the world are still facing the dual pressures of oversupply and insufficient demand. Looking to the future, market uncertainty is still high, and we need to continue to pay attention to the further impact of various countries' macro policies and changes in downstream demand on the steel market.

Your message must be between 20-3,000 characters!

Your message must be between 20-3,000 characters! Please check your E-mail!

Please check your E-mail!  Your message must be between 20-3,000 characters!

Your message must be between 20-3,000 characters! Please check your E-mail!

Please check your E-mail!